Award-winning PDF software

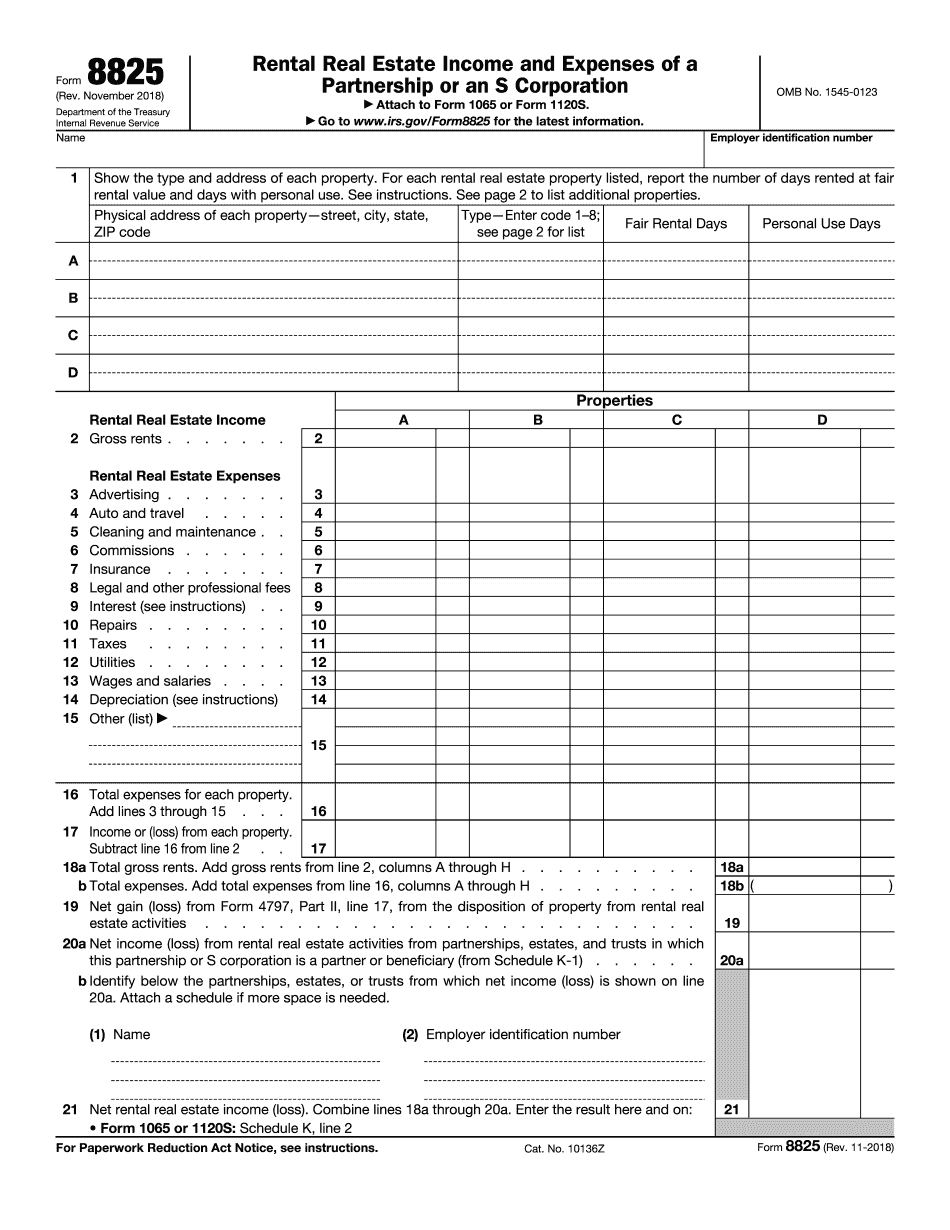

Form 8825 AR: What You Should Know

S corporations using schedule E taxes must report supplemental income or loss reported on IRS form. Form 1099-K—What they will use and how to report it | Quicken Loans Feb 14, 2025 — Quicken Loans uses Schedule E to track capitalized costs incurred in providing services to clients. Form W-2—How it's used, Business owners with employees use a W-2 to report income and expenses. Enter gross income for the financial year. Enter net income for the financial year. Enter the income on Schedule E, Schedule A, or Schedule C (including Schedule C-EZ) for Schedule 12 or Schedules 13 or 20 in your taxes. Enter the expenses for those two items on Form 3114.01, Miscellaneous Expenses, or on Form 3121.01, Miscellaneous Expenses—Business. Form 8889—What it Is, What it looks like, and How To Claim It | IRS Filing Your Tax Return By the Deadline. Form 1040—When to File | Quicken Loans Form 1040—Where to File | Quicken Loans If you're filing a single return, you don't have a choice. You have a choice of filing your return (1040) on paper or using an electronic filing system like TurboT ax. Either way, filing an electronic return is the default if you have not opted out of this service, and you don't get to choose between the two. Get this form from IRS or TurboT ax, and you should be all good. If you're worried about the cost, you can download Form 1040X or 1040-EZ from your computer and mail it in. You have the option of taking the hard copy, but if you prefer paper, TurboT ax comes in at less than 15 per copy, and the form is easily filled and delivered by the mail. For more information, visit our Tax Center page, or contact your local Tax Advisor. When should I file my returns? There are three main scenarios for filing your tax return. You have 3 weeks to file before the deadline. If you don't file your return by March 15th, the IRS will presume you owe your taxes. If that's the case, the IRS will send you a written bill in the amount of your tax refund (or estimated tax). If you have paid your income taxes before you filed, you won't receive that refund, even if you owe the IRS money.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8825 AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8825 AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8825 AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8825 AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.