Award-winning PDF software

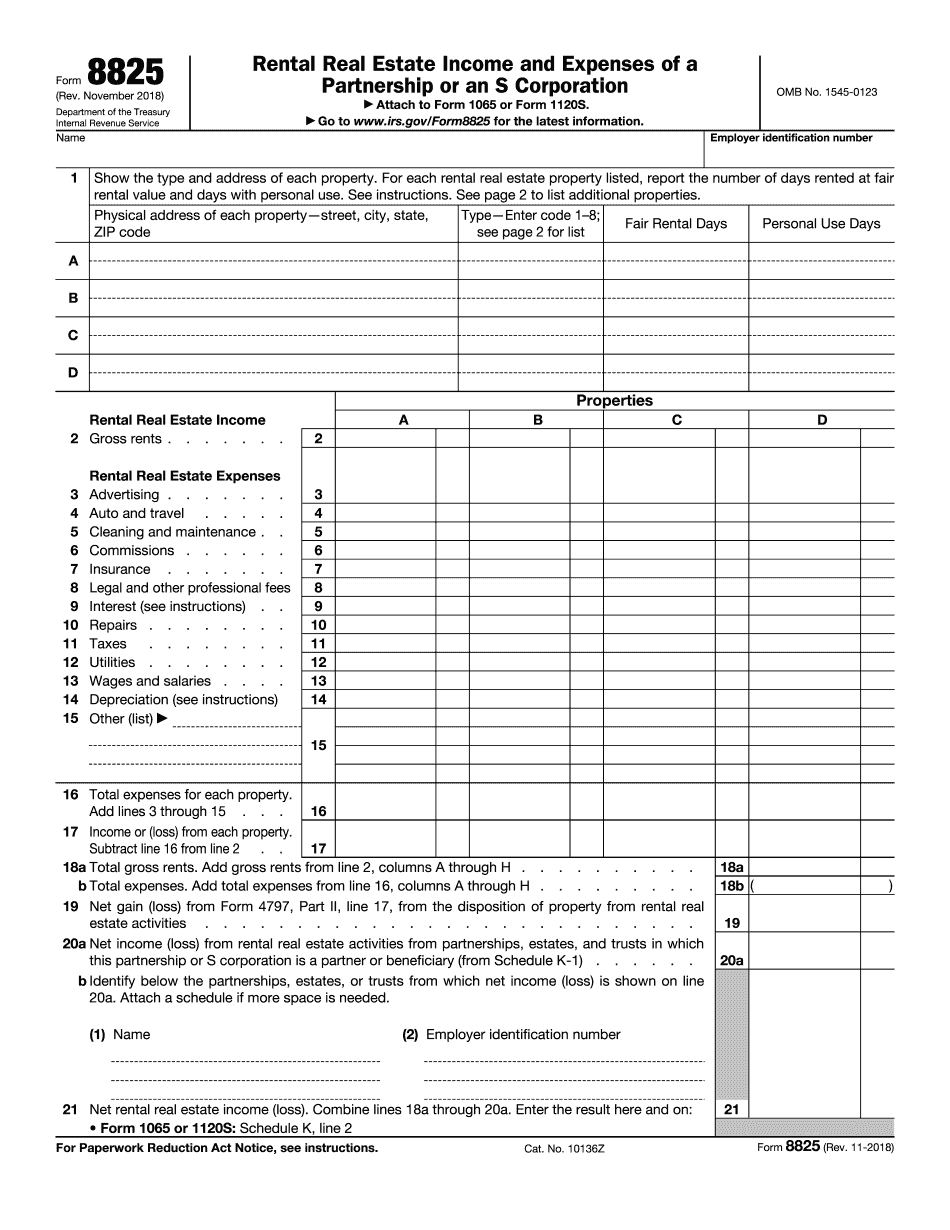

AK Form 8825: What You Should Know

If you own and manage more than one business you may have to file Form 8832. If, like most of us, your business was created solely to make a profit, you may be able to elect to be classified as a Sole Proprietor. However, if your primary business is to make a profit, an election to be classified as a Sole Proprietor is the standard method of doing so. What happens if I refuse to sign a Form 8832? Does my business have to pay a penalty? In most cases, you should not have to pay a penalty for refusing to sign a Form 8832 — unless your business is doing business through Nevada and you are not registered in Nevada for tax What is the purpose of the tax laws? The purpose of the tax statutes, such as the Internal Revenue Code (the tax laws themselves aren't the only law. The IRS often enforces the tax laws — they are the official “lawgivers” of the IRS). The Internal Revenue Code (the law the IRS uses to interpret the tax laws) was originally written to prevent tax evasion. Today, the Internal Revenue Code is used to regulate how the federal government deals with tax and corporate finance. In summary, the purpose of the tax laws is to: 1) tax income, 2) tax corporate income from business activity, 3) tax corporate income from property ownership, 4) tax corporations (non-human entities) based in the United States 5) tax foreign business income, 6) tax income and gain on the sale of stock, 7) tax income on certain sources of income (like dividends and interest, etc.) provided the entity was established in the United States 8) tax all income and capital gains of individuals, partnerships, trusts and estates. Tax is taken at the source — the individual or individual and partnership/trust and estate. In this section, we'll look at: why you must file Form 8832, the process for signing a form 8832, the penalties you could face from refusing to sign and pay up, and how to make sure to send in your form 8332 before April 31, 2025, if you want to file a 1040EZ on or after that day. Form 8832 How to Sign it If your LLC is organized, formed, or formed on, or before April 1, 2010, you must file Form 8332 with the Nevada Secretary of State (the state where you're incorporated).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete AK Form 8825, keep away from glitches and furnish it inside a timely method:

How to complete a AK Form 8825?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your AK Form 8825 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your AK Form 8825 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.