Award-winning PDF software

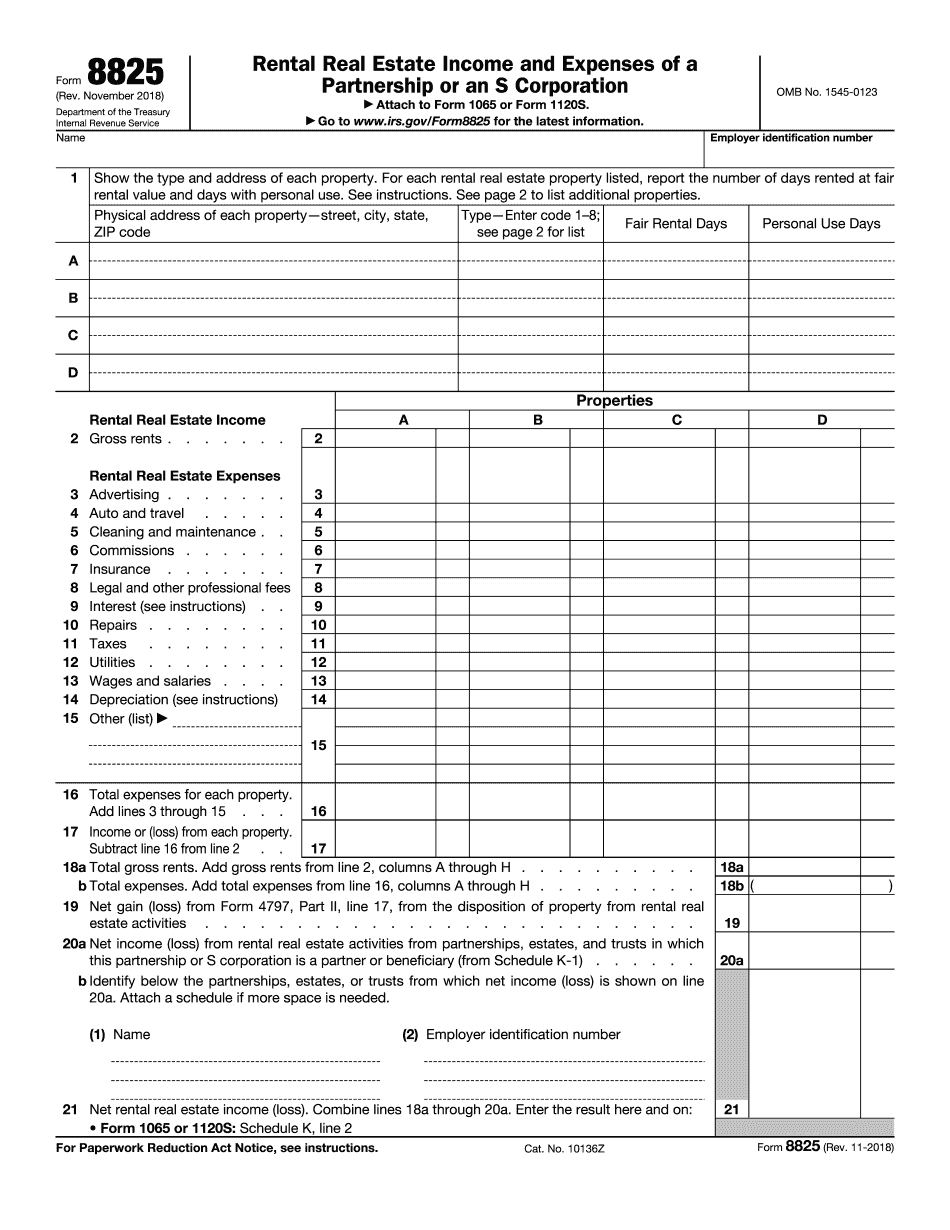

Form 8825 Irving Texas: What You Should Know

Also, available at this address are forms for Reporting Your Rentals IRS Form 941 (for commercial rental income), Form 942 (for rental or lease of a house or building on which rent is paid) and Form 945 (for rental of a home or other property used as a residential unit in a nonprofit religious organization). You must file these forms with the Texas Comptroller and Local Tax Assessor-Collector (in Austin and Dallas), if you operate a commercial rental operation in any of the following Texas cities: El Paso, Elwood, Hays, Llano, McKinney, North Richland Hills, and Waco. If you live in Austin or Dallas, and you rent commercial space (such as a business, apartment building or office building) that is leased directly to a residential tenant, then your operation is subject to local rent control laws if you are in a region with a rental income tax under the Texas Rent Ordinance (ERA). To qualify for a ERA deduction, and if you lease commercial space directly to a residential tenant, rent must be less than the amount the tenant receives or accrues in a calendar month in a tax year and not exceed what the tenant pays on the commercial space in a tax year without a deduction for the actual costs of the commercial space. Also, if you are a resident of a region with a TREE income tax under the Texas Revenues and Expenditures (TREES) Act, your gross rent must be less than the amount you would receive in a calendar month under a Pre-approved residential rental contract. Also, for TREE: The maximum amount you can write off for personal use of your commercial space may be more than what you receive in a calendar month from a residential tenant. These limitations and restrictions may apply even if you are a resident of a Region 2, 3, 4, or 5 city. To receive a tax deduction for the portion of your gross rent that you do not pay as rent, simply add the applicable deductions to calculate your tax liability. Remember that the income from your rental may be more than the amount you would receive in a tax year with no deduction. The income tax deduction you get from rental real estate can be either a gross or deduction. The net income or expenses (other than depreciation, tenant improvements, and rent) may be the basis for your Texas income tax return. You should keep your accounting records accurate.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8825 Irving Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8825 Irving Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8825 Irving Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8825 Irving Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.