Award-winning PDF software

Form 8825 Irvine California: What You Should Know

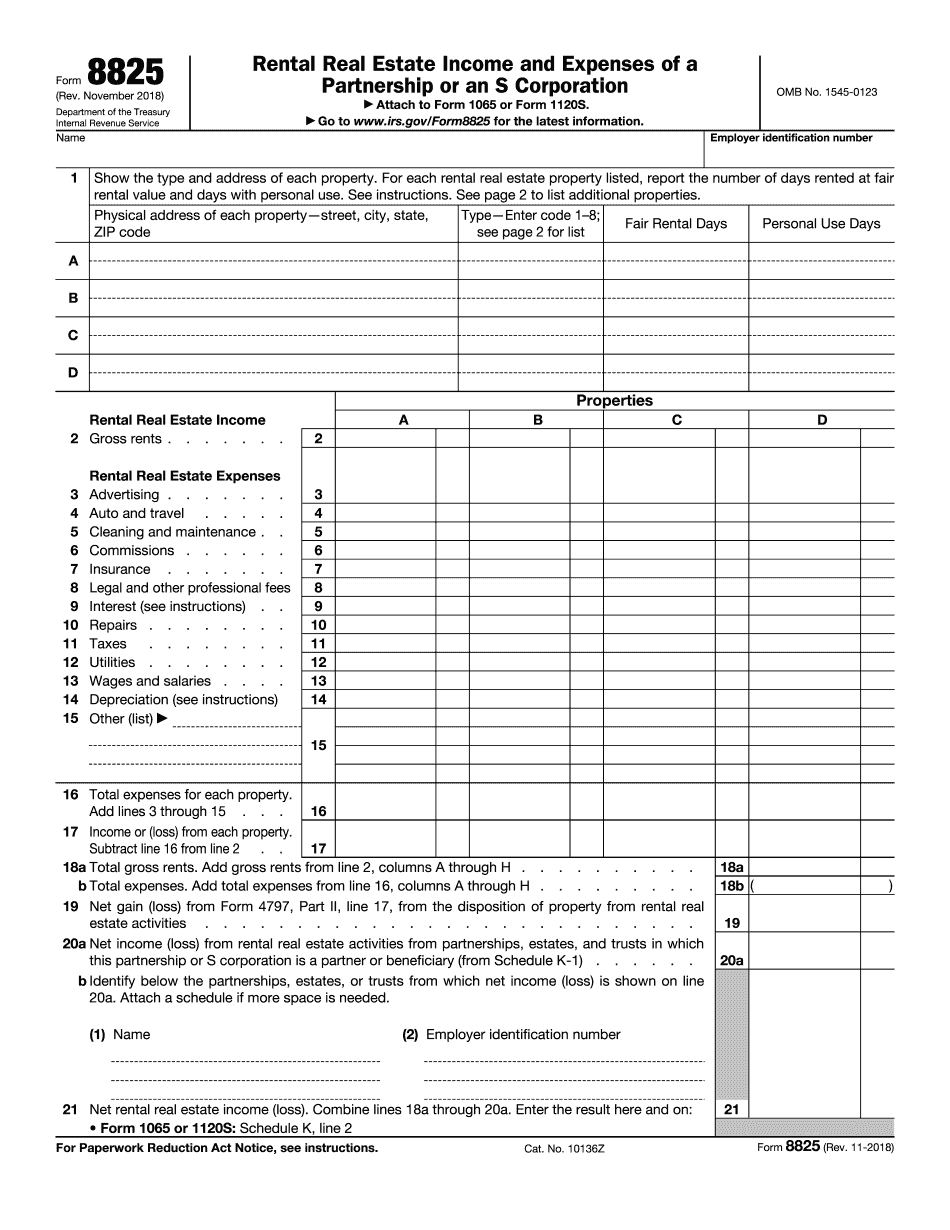

Form 8825 — Deductible Expenses from Home Sales — IRS Use this form to collect tax-free amounts paid for utilities, repairs, maintenance, mortgage interest and taxes paid on your sale of your home. Form 8825: Rental Property Income and — IRS Form 8825 is used to report rental income from your home, such as the amount you paid in property taxes, mortgage interest, repairs, maintenance, utilities and interest on credit card installment debt. Form 8825 — Taxable Capital Gains from Residential Real Estate Property — IRS Use this form for all property in the tax-exempt category that you sold as a “reconstructed” home, that is, where you built the home but did not convert it into occupied housing. Form 8825: Rental Property Income from Residential Real Estate, Form 8825(Rev. November 20, 2018) can only be used for sales that occurred at least one year before the filing date. The rental real estate portion (Form 8825) must be filed annually or on an earlier date if there is an adjustment made for gains in appreciation of that year's rental income. Rentals or lease payments for residential real estate property sold in a prior year can be taken into account in the current year if the subsequent year's gains are not greater than the subsequent year's gain in the previous year. Form 8825 — Qualified Residential Rental Real Estate — IRS Use this form for a qualified rental real estate property you own or are otherwise deemed eligible to own if it is: (a) in a State, district, county or city within the United States that is designated by the U.S. Secretary of Housing and Urban Development as one of the “most dangerous for poverty or one of the more economically distressed areas by local area factors and indicators” by the U.S. Census Bureau; and (b) located in a metropolitan area (the City in which it is located). Using the Form 8825 to calculate your rental housing income and expenses is a two-step process. First, enter the relevant information from your account, and then enter the resulting amount as shown in figure 1. Figure 1 — Enter the relevant information from your account and input the corresponding amount (e.g. gross rental income) on the “Total” line.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8825 Irvine California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8825 Irvine California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8825 Irvine California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8825 Irvine California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.