Award-winning PDF software

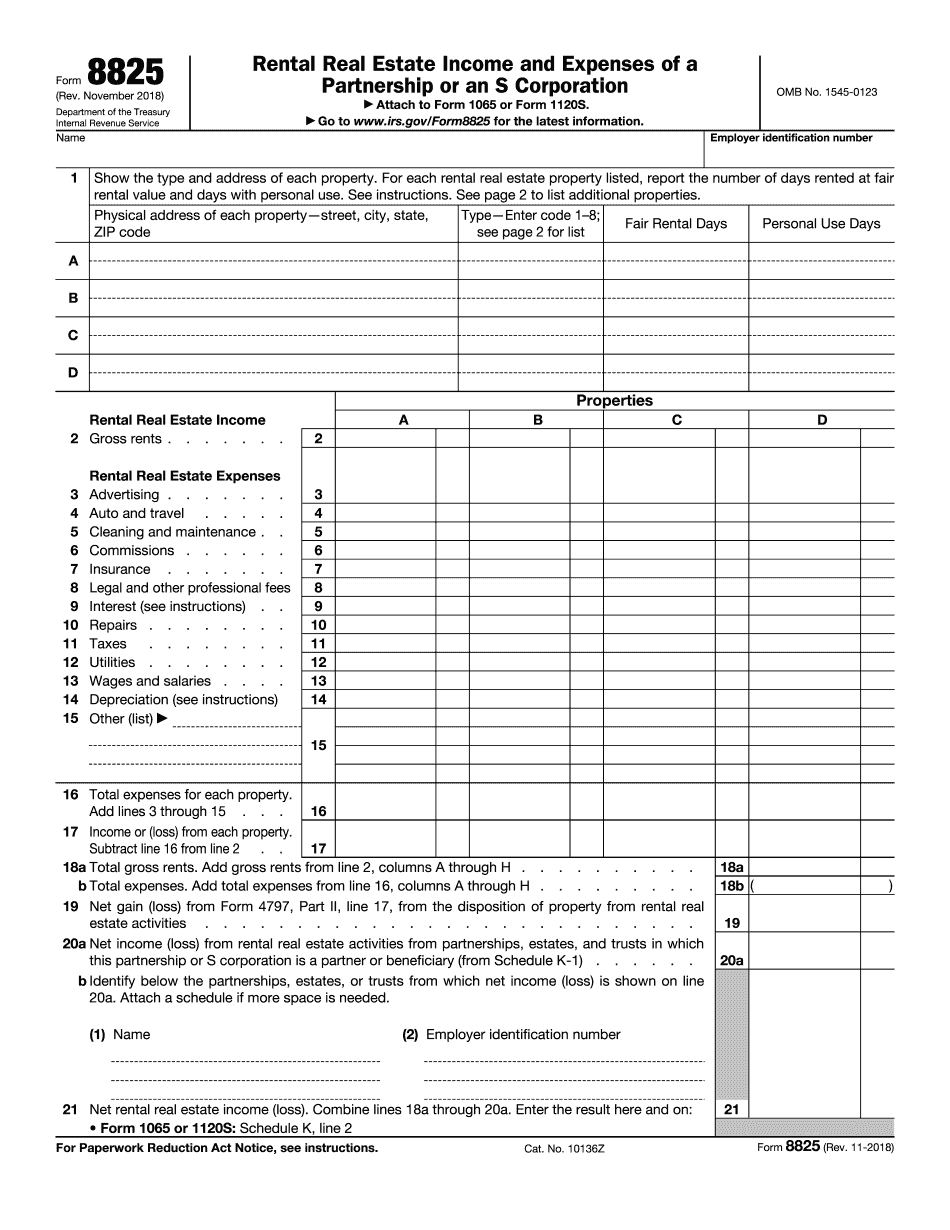

Form 8825 for Pittsburgh Pennsylvania: What You Should Know

PA State Abatement Program City of Pittsburgh: Tax Abatement Application Department of Community and Economic Development and Department of Revenue, Office of Regulatory Regulation (ERA) Pennsylvania Property Tax Abatement & Revenue Bonds Tax Assistance for Businesses/TOT: Property Tax Abatement for Small and Medium Enterprises TaxAbatementPA is a non-profit agency which assists qualified taxpayers to successfully obtain an abatement (tax benefit) on municipal property assessed at up to 125,000 in a community that has a property tax rate greater than the state's average sales tax rate. The goal of the program is to encourage low interest financing for infrastructure and to help reduce the tax burden for small and medium-sized businesses. Each abatement application request includes the applicant's tax year and community tax rate, a copy of a business license, and payment of a bond amount equal to an equal amount of the local municipal income or tax. The abatement amount requested is the estimated average tax savings over the life of the abatement (based on the abatement payment, bond, and sales tax rates). The benefit is a property tax abatement amount which, at a maximum of 20%, generally would be 250 per property. City of Pittsburgh: Abatement Applications City of Pittsburgh: Abatement Applications City of Pittsburgh: Abatement Applications Pennsylvania Property Tax Abatement & Revenue Bonds Pennsylvania Property Tax Abatement & Revenue Bonds City of Pittsburgh: Tax Abatement Applications City of Pittsburgh: Tax Abatement Applications Real Estate Forms | Pittsburgh.gov Complete the City of Pittsburgh Tax Abatement Application to receive a tax exemption on your property. For additional details regarding Abatement Programs, click Here. Pennsylvania Abatement Program City of Pittsburgh: Tax Abatement Application Pennsylvania Property Tax Abatement & Revenue Bonds Tax Abatement PA is a non-profit agency which assists qualified taxpayers to successfully obtain an abatement (tax benefit) on municipal property assessed at up to 125,000 in a community that has a property tax rate greater than the state's average sales tax rate. The goal of the program is to encourage low interest financing for infrastructure and to help reduce the tax burden for small and medium-sized businesses.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8825 for Pittsburgh Pennsylvania, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8825 for Pittsburgh Pennsylvania?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8825 for Pittsburgh Pennsylvania aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8825 for Pittsburgh Pennsylvania from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.