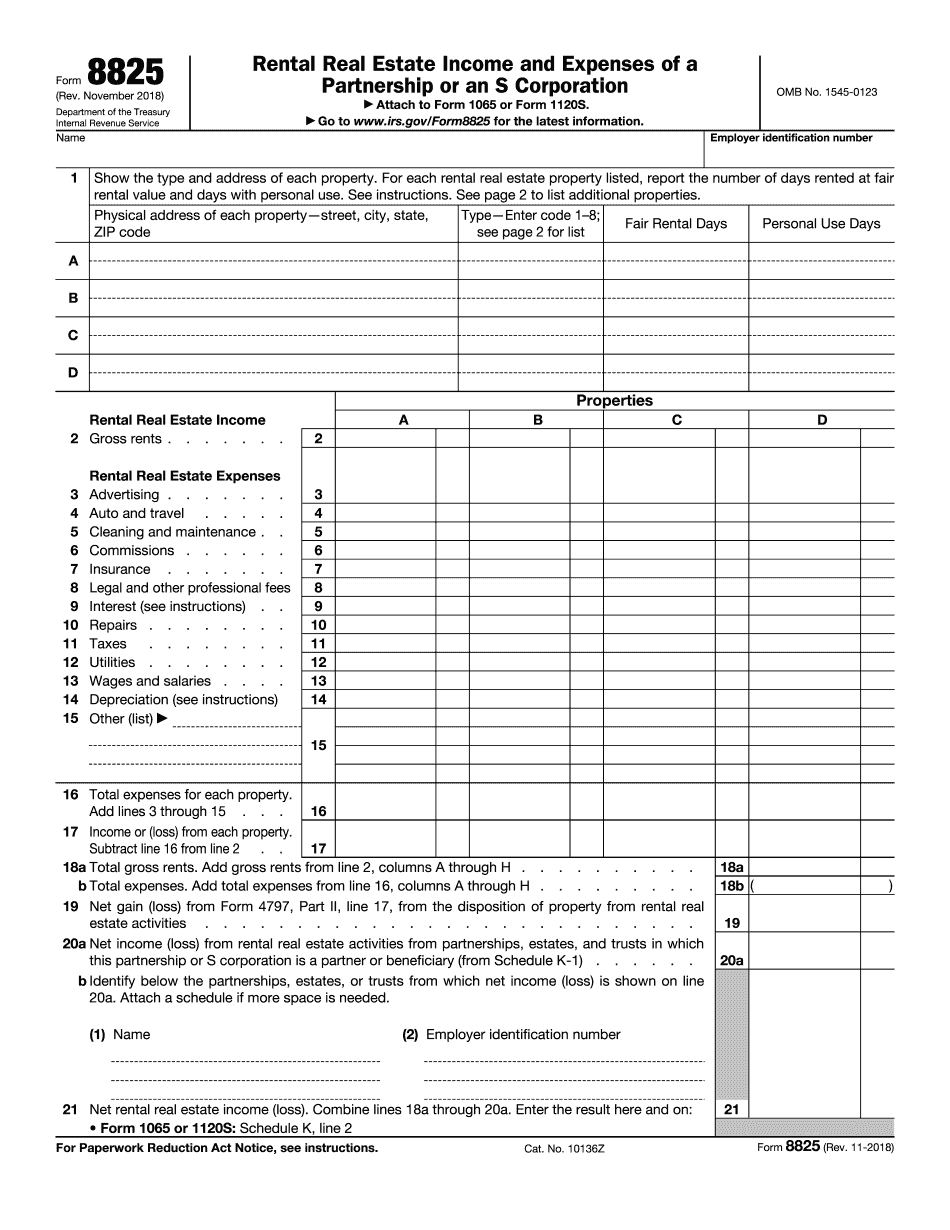

Hey and welcome to today's video blog. My name is Mike Whitbeck from the "Under a Guy" website. Today's topic is using the 88/25 to offset mortgage payments. Let's take a look at what we're going to cover today. First, we'll discuss Fannie Mae guidelines and talk about rental income. Then, we'll go over what the 88/25 is and when it can be considered. After that, we'll review how it applies to 1065s, 1120s, and how to calculate the income from the 88/25. We'll also discuss the difference between the 88/25 and REO. I'll show you a quick online tool that you can use to calculate real income loss. We'll provide some free files for it as well. So, let's get started right away with the training. First, let's talk about the most important thing: when can you consider the 88/25? This process applies only when a borrower is personally obligated to a mortgage that is owned inside of a 1065 or an 1120s. It does not apply anywhere else. If you have a borrower with a 1065 or an 1120s and an 88/25 with multiple properties, it doesn't matter how many properties there are. The information we're about to discuss only applies if the mortgage for one of those properties on the 88/25 is in the borrower's name. This is the very first point, and if this doesn't apply to your situation, then this training is not for you. Now, let's talk about what the 88/25 form is. The 88/25 is similar to a Schedule E for personal use. It includes information such as the property address, rental days, gross rents, and other details similar to what you see on a Schedule E. Comparing the 88/25 to a Schedule E, you'll notice that they have many similarities, with the 88/25 being...

Award-winning PDF software

8825 Form: What You Should Know

If you rent the property, this is pretty useful form to have. Here are some common examples of rental real estate expenses related to your business: Depreciation — This is your annual cash outlay on your rental property. Deductions —Expenses you pay to take advantage of the tax breaks that allowed you to rent your property — these include: The interest you paid on your loan The interest you pay on your advance purchase loans if you owned this property for more than two years. Your expenses for making improvements. Taxes —Here are your depreciation, rental improvements, and other expenses. The expense reports on this tax form are very complete and easy, because you report both the actual costs and what you pay in rent. If you're a landlord, this is a handy form that allows you a lot more flexibility than if you were buying or selling real estate. It's easy to fill out the Form 8825 and it keeps track of the deductions and your expenses for many years. How to Get a Form 8825 You can download a PDF of the IRS Form 8825 and fill it out yourself. I've written out each of the parts of the Form 8825 using a Microsoft Word template (this is not an affiliate link), but you could also use a word processor. If you're using Word, start by going to the Forms/Workbooks/Forms section. Then, in the menu bar, select File/Export as PDF. Now, copy the text of the form into a new workbook. At the top of the workbook, select File > Paste Special > PDF > Save. When you close your workbook, the first page should be filled out with all the information, like any tax forms you've filled out before. You can use the same PDF to check every line in the form. Be sure to check both columns for errors. If you made a mistake, fix the document on your own time and send it back for revision, like the instructions suggest. You don't have an error if the text doesn't match up with what's on the IRS Form 8825.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8825, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8825 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8825 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8825 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8825